In an increasingly interconnected world, the concept of citizenship is no longer confined by geographical boundaries, and citizenship by investment in Panama is the perfect example of this. Countries like Panama have recognized the potential of attracting global...

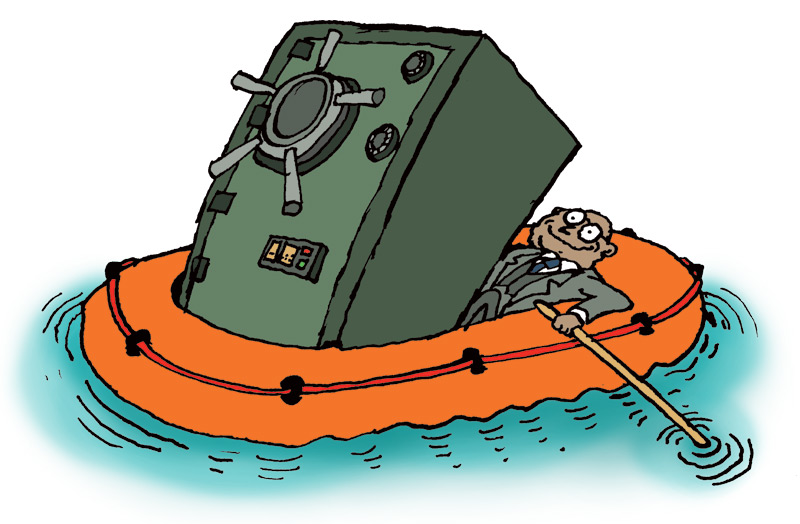

Asset Protection

Don’t Worry, Panama is Still a Tax Haven

The end of 2013 created a panic in Panama amongst the expats and the wealthy citizens when Panama’s National Assembly passed a new law changing the income tax law making worldwide income subject to taxation as in the United States. However, it was deemed a mistake and...

Panama Tax Haven – Benefits of Opening a Business in a Tax Haven

The term “tax haven” commonly refers to countries whose laws allow for anonymous ownership of legal entities like corporations, private foundations and trusts, as well as limited taxation on specific types of corporations. Tax haven also refers to countries with bank...

7 Ways to Lower Income Taxes in Panama

Panama income taxes are a burden to many individuals and businesses alike. So, why pay more than you have too, right? There are many ways for you to lower your Panama income tax, and of course all our recommendations are legal. We've put together a list of 7 ways to...

3 Ways to use a Panama Foundation for Asset Protection

A Panama private interest foundation can protect your assets in several ways. A Panama foundation is a unique legal entity dating back to when wealthy European families created them as an inheritance tool in Medieval times. Liechtenstein, Luxembourg, and Switzerland...